If your company imports into the United States, you know how quickly tariffs and trade policies can shake up your supply chain. One policy change — and suddenly your landed costs or sourcing strategy don’t make sense anymore.

That’s why the latest SC Navigator feature updates make tariff modeling more intuitive and realistic, helping you stay one step ahead. The new Percentage-Based and Rate Attributes let you simulate how duties and trade taxes hit your total cost, and find smarter ways around them.

The US Tariff Landscape

Tariffs are usually a percentage of a product’s declared value, and those percentages vary by country and product type. For US importers, that means:

- Country-specific duties: China, Vietnam, and Mexico might all face different rates.

- Product-based variability: Some goods (like electronics or steel) get hit harder than others.

- Policy swings: Tariff rates can change overnight — so scenario testing isn’t optional anymore.

Modeling these costs correctly ensures you’re not caught off guard by unexpected duty spikes or policy shifts.

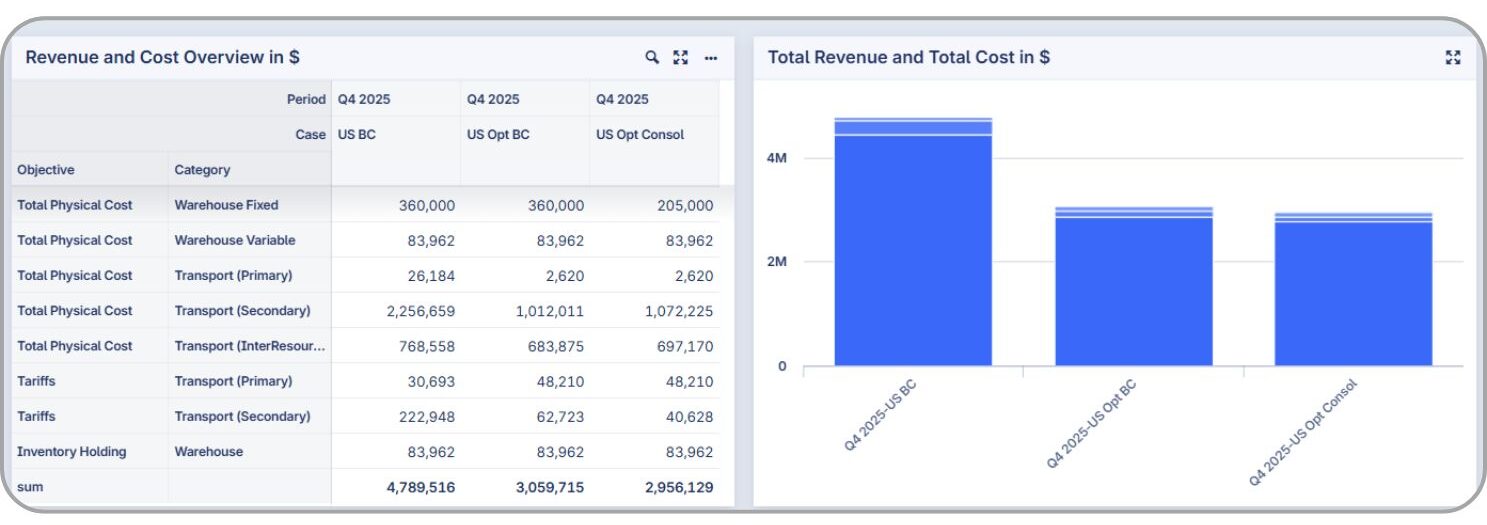

Smarter Tariff Modeling with SC Navigator

1. Percentage-Based Attribute – Tells SC Navigator to treat certain costs as tariff-based, not flat fees, just like how US Customs actually calculates them. Learn how Percentage-Based Tariffs work in SC Navigator.

2. Rate Attribute – Defines the tariff rate (%) applied to your product’s declared value. Together, they calculate the real financial impact of trade duties in your supply chain network.

When both attributes are active, the cost calculation becomes:

Tariff Cost = Volume x Value x % Rate

This accurately models how US Customs calculates duties.

A Quick Example: Imagine you’re importing electronics from three countries:

- China – 25% tariff

- Vietnam – 10% tariff

- Mexico – 0% tariff (thanks to trade deals)

SC Navigator can instantly show whether shifting more volume to Mexico offsets higher transport costs — giving you a clear, data-driven picture of what’s really cheapest under US trade rules.

Best Practices for Tariff Optimization

To make the most of SC Navigator’s new tariff modeling capabilities, it’s important to follow a few best practices:

- Include tariffs in total landed cost modeling, not just transport or labor costs.

- Run “what-if” scenarios to stress-test your network against tariff shocks and find the best sourcing alternatives under different trade policies.

- Update rates regularly as policies evolve.

To make it easier to get started, check out our step-by-step guide on optimizing tariffs in SC Navigator.

The Bottom Line

With its new Percentage-Based and Rate features, SC Navigator makes it easy to build tariff-aware, resilient supply chains. Whether tariffs go up, down, or sideways, you’ll be ready to optimize fast and stay competitive in an unpredictable trade world.

Want to see how these features work in SC Navigator?