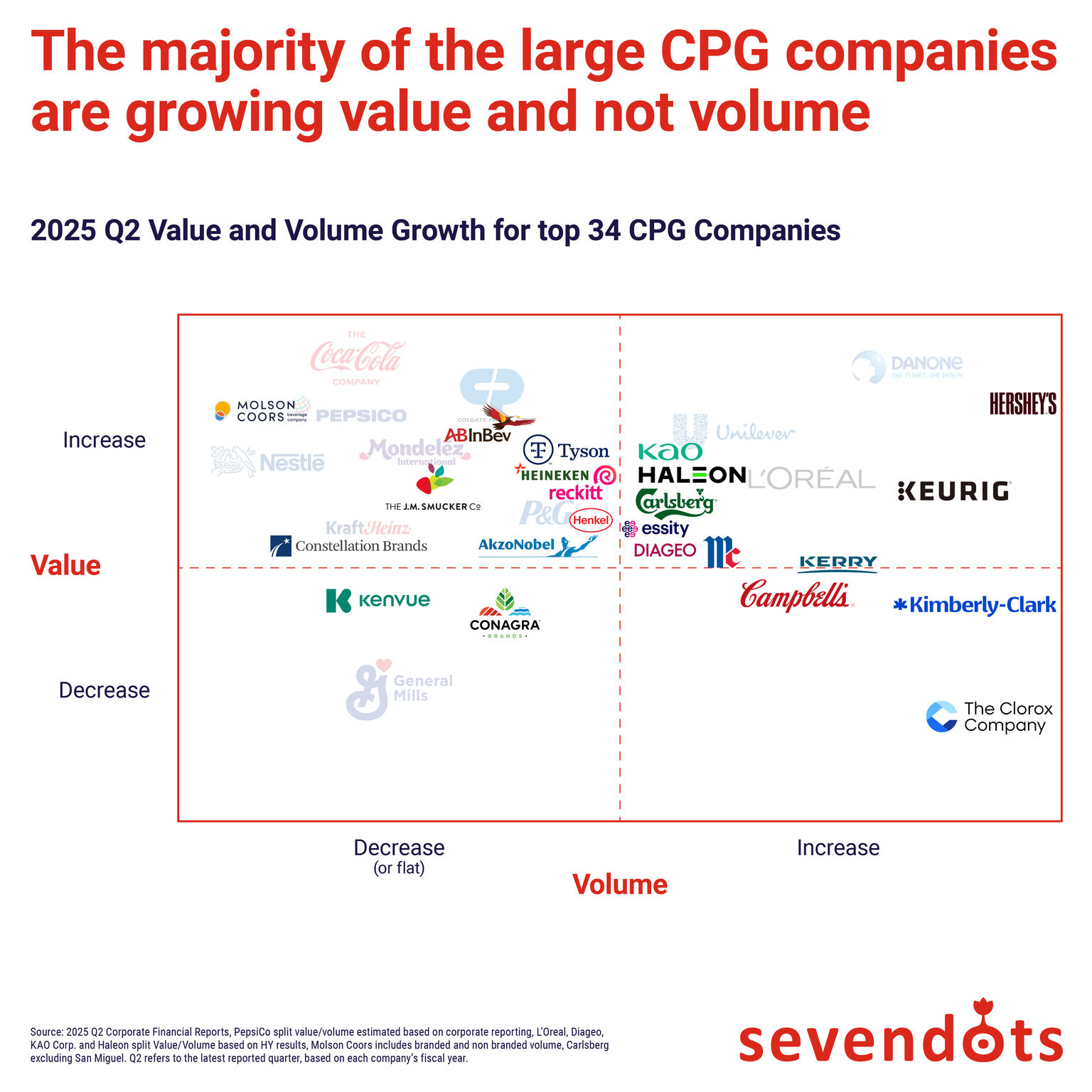

The latest Q2 2025 results for the world’s largest consumer packaged goods (CPG) companies highlight a striking reality: most are growing value, not volume. The analysis of 34 leading players shows that while pricing power has sustained top-line growth, true volume expansion remains elusive.

A handful of companies, like Hershey’s, Unilever, Kao, and Keurig, among them, are proving it can be done. But for the majority, flat or declining volumes are raising tough questions about what comes next.

This shift has profound implications for how CPG companies design and run their supply chains.

Value without volume: What it means for supply chains

The chart tells a clear story. While value growth is widespread, volume growth is concentrated in a small group of companies. Those winners are succeeding not by relying on scale alone but by making sharper portfolio choices, focusing geographically, and executing with discipline.

For supply chain leaders, this means the historical model of “build scale, chase efficiency, and push price increases downstream” is no longer enough. Pricing levers are plateauing. The next era of competitive advantage in CPG will be defined by penetration, agility, and local execution, all powered by supply chain strategy.

The new supply chain playbook for CPG leaders

If pricing power has been the story of the past three years, supply chain agility will be the story of the next three. To move beyond flat volumes, CPG leaders must rethink the core principles that have guided their networks for decades. The new playbook is less about scale and cost, and more about flexibility, relevance, and speed.

1. Double Down on Cost & Cash Excellence

Advanced modeling unlocks cost savings, working capital, and service balance. Examples:

A prominent consumer healthcare company saved 10% of costs across a 3-tier distribution and manufacturing network by accepting a small impact on customer lead time.

A prominent consumer healthcare company saved 10% of costs across a 3-tier distribution and manufacturing network by accepting a small impact on customer lead time.- A multi-national paint and coatings manufacturer has realised substantial savings by optimizing the use of their manufacturing footprint – repurposing or relocating manufacturing capabilities when the demand profile changes and reviewing which out-sourced products can cost-effectively be brought in-house.

2. Rebalance From Efficiency to Responsiveness

Traditional cost-efficiency-focused supply chains give way to responsive, scenario-driven models. Examples:

- After separating from Danone, Horizon Organic used SC Navigator to rapidly model and compare supply chain scenarios, enabling strategic decisions to build an independent, aligned network across 16 distribution centers, manufacturing sites, and milk producers. They manage to dynamically model milk supply variability and seasonal demand, enabling agile network adjustments.

- Tereos Sugar & Energy Brazil improved S&OP with AIMMS-based scenario generation spanning over 1.3 million operational variables, enabling rapid, fact-based decisions across the supply chain—from fields to customers.

3. Build Localized Supply Chains to Unlock Growth

Tailoring production and supply by market and channel enhances growth potential. Examples:

- Horizon Organic also optimized warehouse and production footprints to meet regional U.S. demand and reduce transportation costs.

- Heineken optimizes brewery networks, especially in growth markets like Mexico, blending local relevance with global efficiency.

4. Simplify Portfolios, Enable Premiumization

Streamlining SKUs and modular production boosts capital efficiency and market agility. Example:

- Nampak uses AIMMS scheduling to reduce SKU complexity and accelerate premium product runs.

5. Optimize Multi-Channel Distribution

Several well-known retailers across 3 different continents are using AIMMS SC Navigator to understand how to serve their growing e-commerce offering alongside traditional store demand.

Here are the most common questions that they are trying to answer.

- Should it be served out of existing stores, out of dedicated fulfilment centres, or a mix of both?

- How much investment in capacity is required to support the expected growth?

- How can they keep up with ever more demanding customer service expectations?

The path forward

The lesson from Q2 2025 is unmistakable: scale alone no longer guarantees growth. The companies that are winning on volume are doing so by aligning portfolio, geography, and execution with precision. Supply chain leaders must follow suit.

The next wave of CPG winners will not be those who merely push pricing power to its limits. They will be the companies whose supply chains pivot from being cost optimizers to becoming growth enablers — agile, local-first networks that deliver the right product, in the right place, at the right time.

In a world where consumers are more discerning, retailers more demanding, and disruption is the new normal, supply chain agility is no longer a back-office function. It is the frontline of competitive advantage.

Are you ready to optimize your CPG supply chain? Talk to our experts.