How Retail Supply Chains are Evolving in 2023

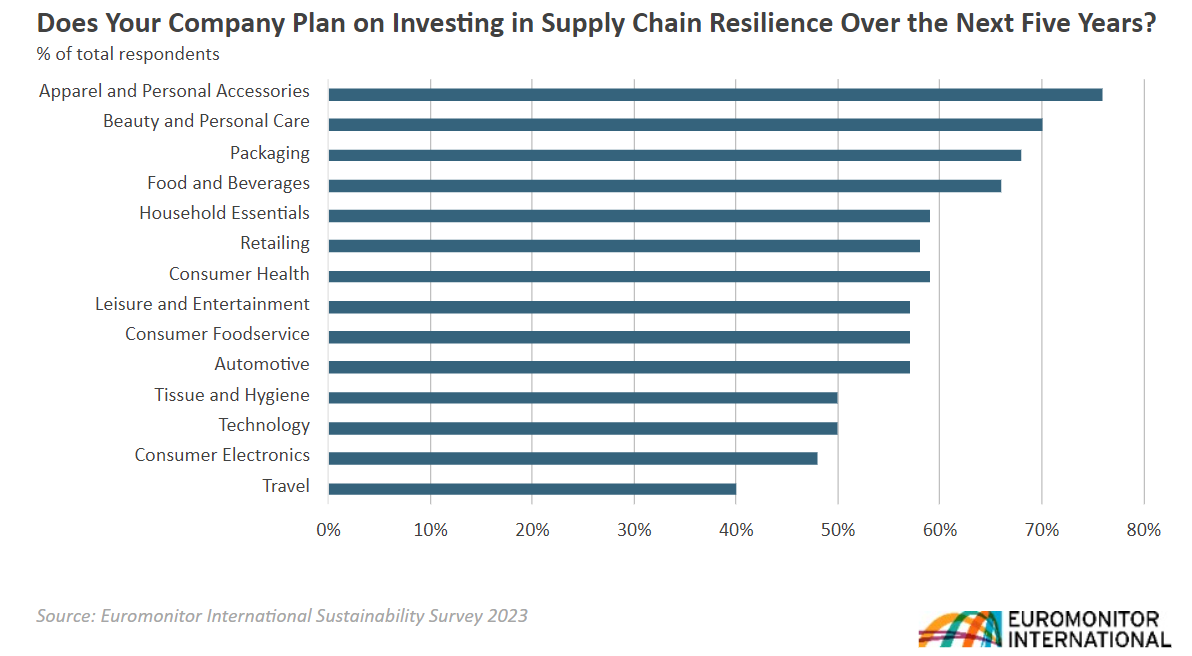

Supply chain robustness is emerging as a paramount focus for businesses. According to the 2023 Euromonitor International Sustainability Survey, 56% of companies worldwide expressed their intent to ramp up investments in enhancing supply chain stability.

Sectors characterized by extended supply chains, like packaging, and those deeply dependent on streamlined transportation systems, including apparel and retail, are at the forefront of this movement.

What’s happening in the retail and e-commerce sector?

Supply chain design for the E-commerce industry is increasingly focused on bringing products closer to customers for more efficient and cost-effective service. Retailers have been re-evaluating traditional network structures, placing more inventory near demand centers.

The COVID-19 pandemic emphasized the importance of this strategy as physical stores shut down and e-commerce became vital. Many retailers adapted by using store-based fulfillment methods like curbside pickup and ship-from-store operations. Even as physical retail returns, the lessons from the pandemic stress the benefits of using stores for e-commerce fulfillment and decentralizing inventory.

Following the “bullwhip effect” that caused over-ordering and overstocks in 2021 and 2022, companies are now favoring a “just-in-time” approach. The ongoing challenge is how e-commerce network design has evolved post-pandemic, and how data, analytics, changing demand, and logistics impact network decisions.

As an example, see how a leading retailer optimized fact-based merchandise and promotions decisions with AIMMS.

Speaking about supply chain network design, adaptability and robustness in e-commerce network design hinges on utilizing appropriate analytical tools. The development of “digital twins” has emerged as a favored method. This entails crafting a digital reflection of a fulfillment network or supply chain, empowering operations managers to simulate diverse scenarios and assess the impact of potential changes.

Speed of delivery is a big competitive advantage

Due to the pandemic’s impact on supply chains since 2020, consumers have become aware that deliveries can’t always be instant. Increased shipping costs at the checkout have also made them more receptive to longer transit times in favor of cost savings.

How has Amazon tackled this challenge? Here are a few changes that improved the performance of Prime’s delivery network:

- “Regionalizing” their U.S. operations network: Items shipped from nearby fulfillment centers or delivery stations help packages get to customers faster and with less carbon emissions.

- Placing products closer to end customers: By investing in advanced predictive analytics and scenario modeling solutions, Amazon is able to better predict which products customers buy across the US and when they want them which helps to estimate the right level of inventory, in the right places, at the right time.

- Growing their same-day delivery network: Same-day facilities are smaller buildings situated close to the large metro areas they serve, which decreases the distance to customers. This year, the distance between their sites and the customer decreased by 15%, with 12% fewer touchpoints within their middle mile network.

Another optimization success story comes from Peapod. Together with our partners at Districon, we developed a tool that provides a visual diagram indicating which items should be in the wareroom and how they should be placed on shelves. The math that determines which items to move happens behind the scenes and is fully automated.

Read how Peapod drives supply chain innovation and efficiency with AIMMS.

Importance of returns management

The cost-of-living crisis is affecting not just sales of goods, with 6-in-10 adults cutting back on non-essential purchases, but also influencing return behaviors. Research from the Advanced Supply Chain Group reveals that 47% of consumers are returning their purchases, possibly due to regret or reevaluation of necessity.

Retailers are seeing an increase in “disingenuous returns”, with almost two-thirds noticing a rise and 17% of shoppers admitting they’re more prone to such returns because of the economic strain. Additionally, 62% of shoppers expect a free return policy and 58% want speedy refunds.

Here are a few recommendations from Advanced Supply Chain Group (ASCG).

- Restricting Payment Terms: Avoid charging for returns as it can deter sales.

- Smooth Return Process: Ensure quick returns and clear visibility on return statuses.

- Comprehensive Data View: Retailers should maintain a holistic view of their supply chain.

- Quickly Re-process Returned Goods: Efficiently prepare returned items for resale.

While returned products strain supply chains due to reprocessing needs, a well-handled returns policy can enhance customer loyalty and possibly boost future sales. Despite the rise in problematic false returns, quick refunds can motivate shoppers to repurchase. When customers promptly receive refunds, they’re more likely to shop with the same retailer again. Returns must be a core supply chain strategy component to ensure fast refunds and meet customer expectations.

End note

In closing, the evolution of retail supply chains paints a picture of adaptation, resilience, and a relentless commitment to enhancing customer experiences. As businesses continue to navigate uncertainties, one thing remains clear: the supply chain’s ability to innovate and cater to customer expectations will define success in an ever-evolving marketplace. With each strategic move and innovative solution, the retail industry paves the way for a more efficient, sustainable, and customer-centric future.

Curious how SC Navigator, our network design application, can help you make optimal decisions for your retail supply chain?

What our readers are saying

Comments are closed.

Fascinating read The development of the retail supply chain is critical in today’s dynamic market. It’s clear that technology and adaptability are driving this change. Retailers that embrace these changes will be better positioned for success. Thank you for sharing this insightful article.